Investment Policy

- 01. Management Philosophy

- 02. Contribution to Regional Revitalization and Development of Attractive Communities

- 03. Investment Policy

01. Management Philosophy

Fukuoka REIT, as a region-specific REIT that has investment target area limited as a rule to the entire Kyushu region (including Okinawa Prefecture and Yamaguchi Prefecture) centering on Fukuoka (the “Fukuoka and Kyushu area”), will aim to secure the best interests of our unitholders by utilizing the information and expertise of Fukuoka Realty, an asset management company knowledgeable about the Fukuoka and Kyushu area.

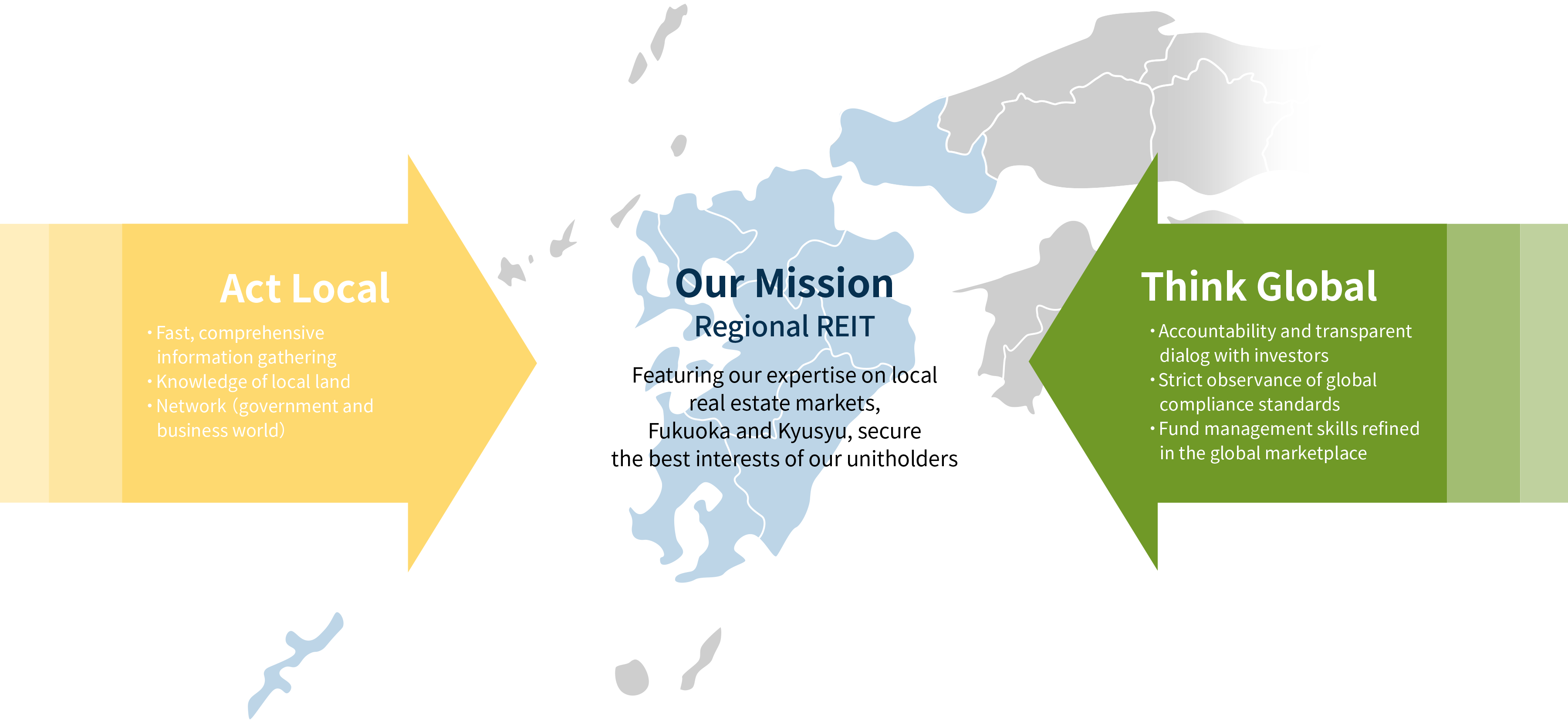

Our Mission

With our strength in knowing the local characteristics of real estate, which is a very regional-specific business, Fukuoka REIT invests in real estate for rent in the Fukuoka and Kyushu area and appropriately manages the invested real estate in an effort to continue to secure stable earnings over the medium to long term and provide stable dividends into the future.

Act Local

We—Fukuoka REIT and Fukuoka Realty—are currently the only listed real estate investment corporation and its asset management company with registration outside of the Tokyo metropolitan area or the Kansai area under the Act on Investment Trusts and Investment Corporations, the Financial Instruments and Exchange Act and these Acts’ enforcement orders. We also seek differentiation in the selection of investment target properties and the management of owned assets through enhancement of our information gathering ability and ability to discern the profitability of properties by utilizing our speed and depth of information based on knowledge of local land and broad network centering on the local government and business world.

Think Global

We—Fukuoka REIT and Fukuoka Realty—will proactively engage in IR activities to fulfil our accountability to global capital markets. In conjunction, we will take heed of Fukuoka Realty’s corporate governance and compliance. Regarding real estate and financial markets, Fukuoka REIT will keep closely tracking movements occurring across the whole of Japan and the entire world, taking into consideration the logic of capital markets with global ideas, and appropriately reflecting such in our asset management. We will also keep diligently pursuing dialogue with investors, focusing on fulfilling our accountability, and utilizing Fukuoka Realty’s fund management skills for investors under a strict compliance policy.

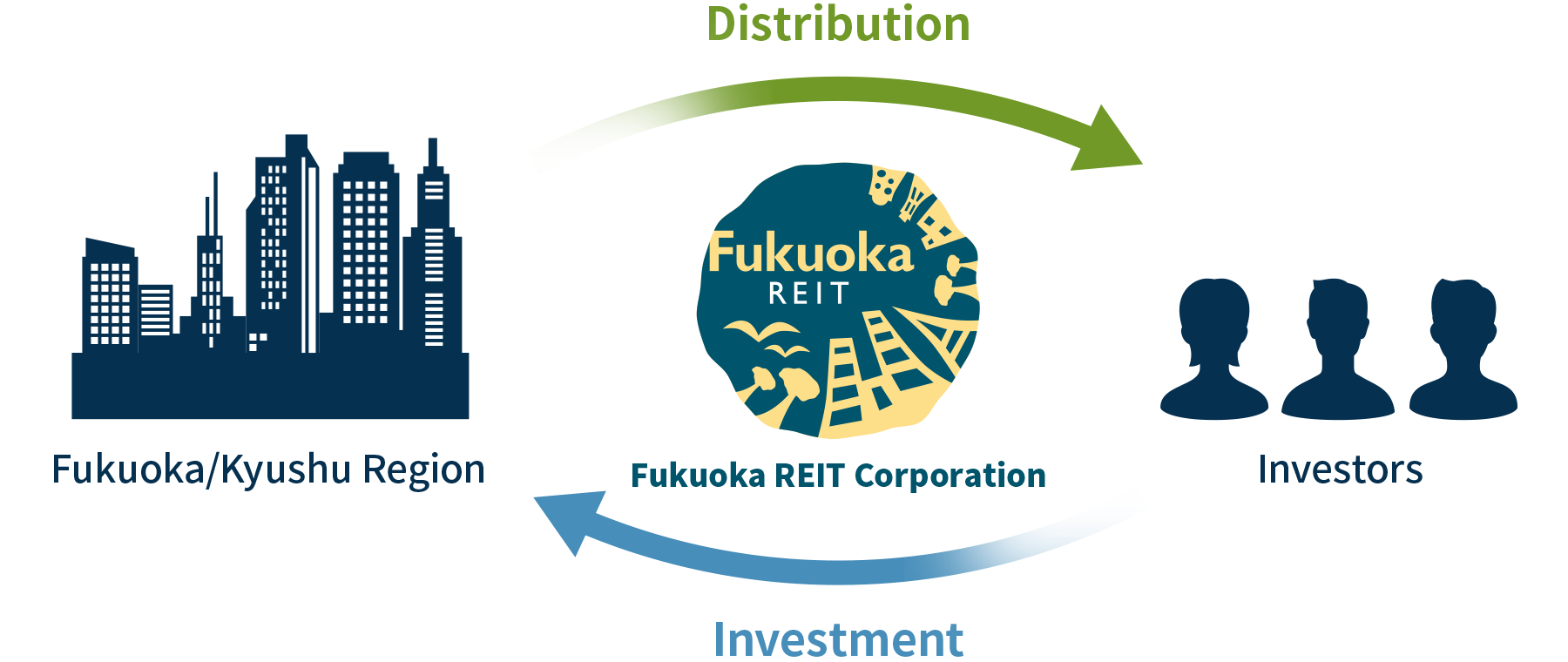

02. Contribution to Regional Revitalization and Development of Attractive Communities

We—Fukuoka REIT and Fukuoka Realty—believe that attracting domestic and foreign blue-chip investment funds to regional real estate finance markets will stimulate community development of the Fukuoka and Kyushu area. Although we are not directly involved in community development or real estate development, we expect that our acquisition of properties will lead to new funds passing to sellers and part of the funds being directed toward new development, etc. With funds injected into Fukuoka REIT from Japan and overseas, new investment funds will flow to the Fukuoka and Kyushu area as a whole. Based on this perspective, we believe that we can contribute to regional revitalization and community development of the Fukuoka and Kyushu area. In addition, funds will be returned to the unitholders investing in Fukuoka REIT by distributing the earnings from owned assets. Fukuoka REIT believes that regional growth through community development will likely lead to greater investment opportunities and revenue of owned assets for Fukuoka REIT, too, and thus serves the interests of unitholders. In this manner, through promotion of community development and revitalization of regional economies in the Fukuoka and Kyushu area, we will aim for earnings stability of Fukuoka REIT.

03. Investment Policy

Invigoration of the Region and Contribution to Creating Attractive Cities

Investment area

- Fukuoka City area

- 60-90%

- Other areas of Kyushu(Including Okinawa and Yamaguchi)

- 10-30%

- Others

- 0-10%

Investment type

- Retail

- 40-70%

- Office buildings

- 20-50%

- OthersLogistics, Residence, Hotel and other facilities

- 0-30%

In March 2019, FRC changed the principle for investment ratio for "Investment type" under the basic asset management policy.

By lowering the upper limit of the investment ratio for retail by 10% and the lower limit by 20% from the previous policy, as well as raising the upper limit of the investment ratio for office buildings and others by 10%, investment in excellent properties other than retail can be considered more flexibly.