Unitholders' Info

01. IR Policy

Basic Policy on Information Disclosure

- Fukuoka REIT Corporation (FRC) shall conduct fair and appropriate information disclosure in compliance with laws and regulations as well as the rules set forth by the Tokyo Stock Exchange and Fukuoka Stock Exchange, etc.

- In conducting information disclosure, FRC endeavors to do so in a prompt, accurate and fair manner consistently from the viewpoint of unitholders and other stakeholders, fully recognizing that timely and appropriate information disclosure provides the basis of a sound securities market.

- In conducting IR activities and other communications for its trading participants including such parties as financial instruments transaction business operators and unitholders, FRC will observe the fair disclosure rules set forth in the Financial Instruments and Exchange Act, and disclose information in a prompt, accurate and fair manner in accordance with the rules as required by the rules.

Silent Period

In order to prevent any leakage of information that may impact the investment unit price during the period in which FRC prepares for the announcement of its performance results as well as to ensure fairness in information disclosure, FRC has set the period from the day following the closing of accounts of each fiscal period to the announcement date of relevant performance results as a silent period, in which FRC does not conduct IR activities as a rule. During the silent period, FRC shall refrain from answering any questions or making comments on the performance results. However, if it is anticipated that FRC will significantly revise the performance forecast and the like during the silent period, FRC shall disclose it based on the timely disclosure rules set forth by the Tokyo Stock Exchange and the Fukuoka Stock Exchange as a rule. Furthermore, even during the silent period, FRC shall respond to inquiries, etc. on information that is within the scope of what has already been disclosed.

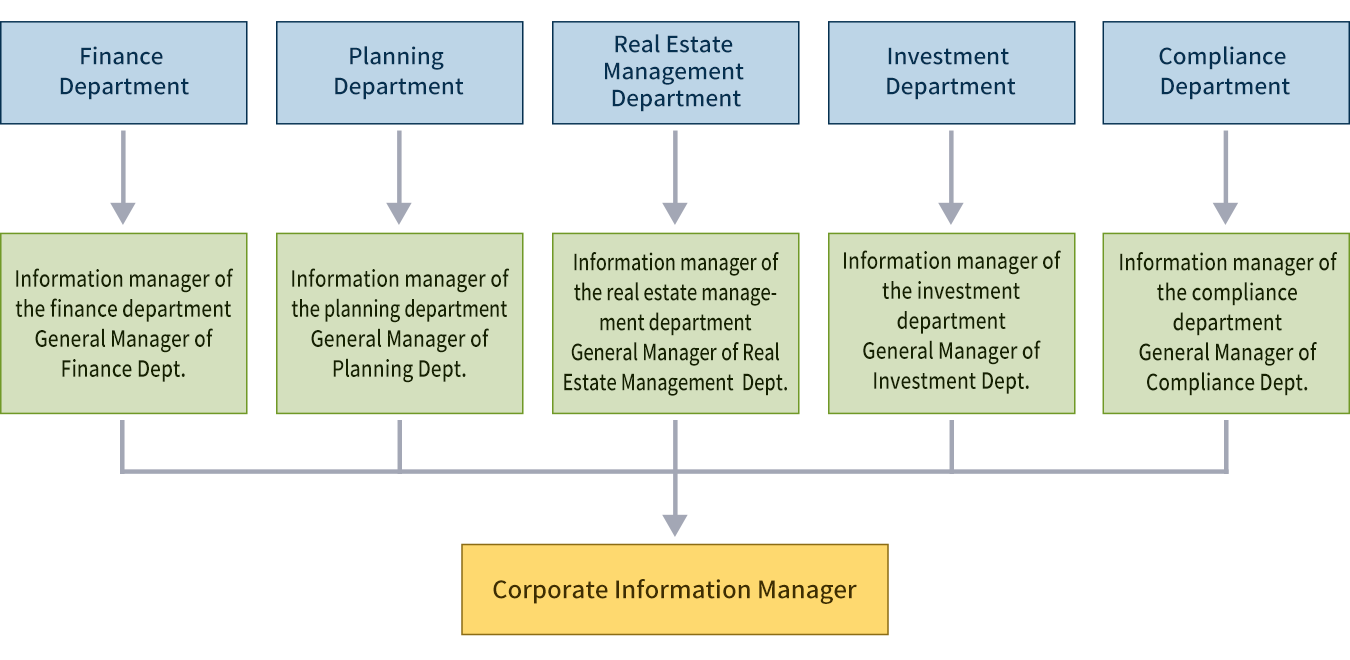

Flow for information disclosure

The Corporate Information Manager decides whether or not to disclose the information subject to disclosure received from the information manager of each department, after consulting with the General Manager of the Finance Department and the General Manager of the Compliance Department, depending on the level of information.

02. General Meeting of Unitholders

Certain matters (such as amendments to the Articles of Incorporation and election and dismissal of Executive Director and Supervisory Directors) concerning Fukuoka REIT as specified in the Investment Trusts Act and the Articles of Incorporation of Fukuoka REIT are resolved at general unitholders' meetings. The general meeting of unitholders of Fukuoka REIT is held once every two years.

10th General Meeting of Unitholders (Held on May 25, 2022)

- Notice of Convocation Notice of Convocation [439KB]

- Notice of Resolutions Notice of Resolutions [121KB]

Ninth General Meeting of Unitholders (Held on May 26, 2020)

- Notice of Convocation Notice of Convocation [263KB]

- Notice of Resolutions Notice of Resolutions [41.4KB]

Eighth General Meeting of Unitholders (Held on May 24, 2018)

- Notice of Convocation (Japanese) Notice of Convocation (Japanese) [410KB]

Seventh General Meeting of Unitholders (Held on May 25, 2016)

- Notice of Convocation (Japanese) Notice of Convocation (Japanese) [407KB]

Sixth General Meeting of Unitholders (Held on May 22, 2014)

- Notice of Convocation (Japanese) Notice of Convocation (Japanese) [242KB]

Fifth General Meeting of Unitholders (Held on May 23, 2012)

- Notice of Convocation (Japanese) Notice of Convocation (Japanese) [279KB]

Fourth General Meeting of Unitholders (Held on May 26, 2010)

- Notice of Convocation (Japanese) Notice of Convocation (Japanese) [470KB]

Third General Meeting of Unitholders (Held on May 29, 2008)

- Notice of Convocation (Japanese) Notice of Convocation (Japanese) [436KB]

Second General Meeting of Unitholders (Held on June 27, 2006)

- Notice of Convocation (Japanese) Notice of Convocation (Japanese) [345KB]

First General Meeting of Unitholders (Held on August 20, 2004)

- Partial amendments to the Articles of Incorporation Partial amendments to the Articles of Incorporation []

03. Information on Investment Units

Tax Treatment

Taxation to Fukuoka REIT's unitholders who are residents in Japan or Japanese corporations and the general tax treatment that applies to the investment corporation are indicated in the following document (Japanese). Please note that the content of the information below may be modified due to revisions of tax laws, etc. Moreover, different treatment of taxation may apply depending on the specific situations of individual unitholders. For more details, please see below.

- Tax Treatment [311KB]

Rights of Unitholders and Investment Corporation Bond Holders

Investment Risks

The text is an excerpt of the “investment risk” described in the Fukuoka REIT Investment Corporation Securities Report. Therefore, the reference points described in the text may not be included in the text. Please refer to the relevant securities report when viewing the reference points.